DAN.com (by Undeveloped) has some great pricing features that are especially useful for domain name sellers (and buyers) that are located in Europe. But sellers outside of Europe also need to tweak a couple of settings so that their domain name prices are presented correctly to the buyers.

This post is about what features DAN gives to international sellers (especially from Europe) and how to correctly setup domain name pricing at DAN.

The main and most important feature that DAN.com has (while no others provide it) is that it will calculate whether the buyer needs to pay for VAT tax or not. That is if the seller is located in the European Union (EU). But there are now 28 countries in the European Union so this is a fairly big amount of sellers.

Basically a seller that is in the European Union needs to charge VAT tax depending on the location of the buyer.

For example I am from Greece that is part of the European Union. These are the 3 different scenarios for charging VAT tax EU sellers have depending on the location of the buyer:

- If the buyer is located outside the EU then seller charges no VAT.

- If the buyer is located in the same country as the seller then the seller charges a VAT tax.

- If the buyer is from the EU then:

a. Seller has to charge a VAT tax if the buyer has no valid VAT number. (i.e. they are not registered for VAT in their country)

b. Seller will not charge a VAT tax if the buyer has a valid VAT number. (i.e. they are a company)

Some countries treat VAT a bit differently. For example the United Kingdom only requires companies to register for VAT if they have revenue above some threshold.

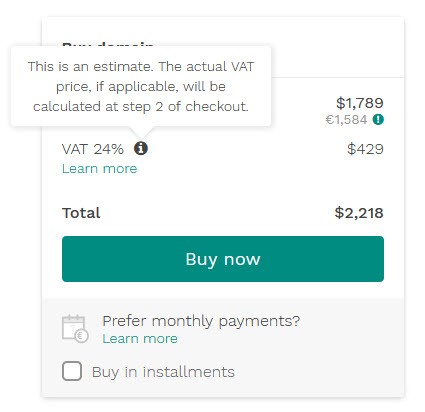

One important thing to remember is that Value Added Tax (VAT) is different in every country. It ranges from 8% up to 27%. In Greece VAT tax is at 24%. DAN.com calculates that during checkout.

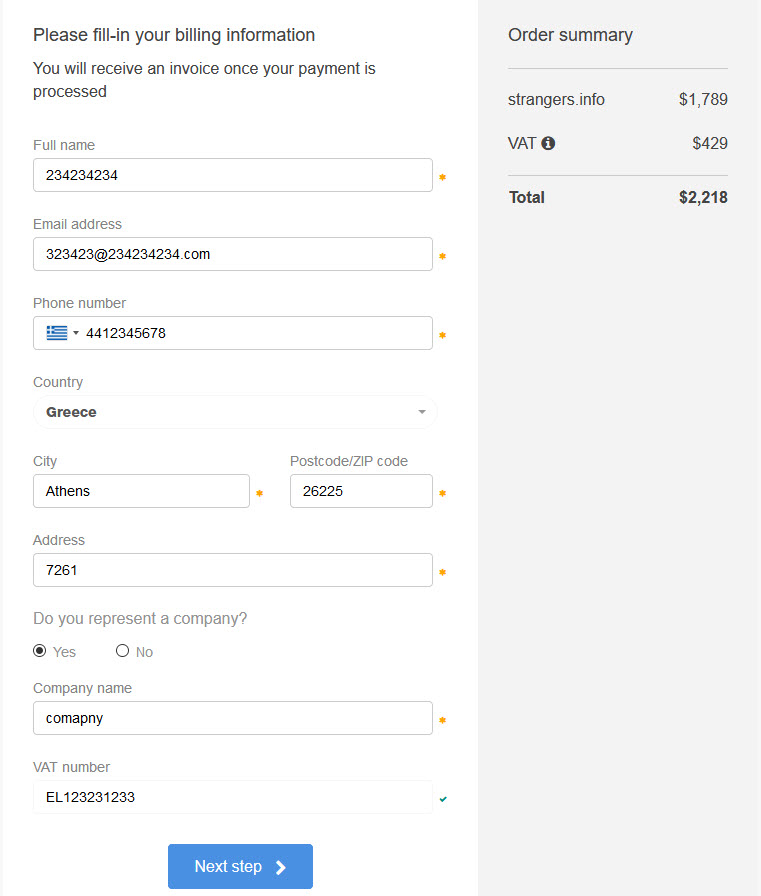

The VAT calculation happens during the domain name checkout. DAN has a very good validation algorithm based on the VAT creation method of each country. Of course someone might try to game the system so the proper VAT validation is made by the seller at the VIES VAT number validation system.

Some EU sellers might say that they don’t really care about VAT. One option is that they can simply incorporate the VAT tax in their price after the sale. But for me (and for all EU sellers) that would mean taking 24% less from my domain name sale as I will have to pay my tax office that 24% at the end of the month.

Another option is to simply increase your domain name prices by 24% and be done with it. But that will not let you define your BIN prices at the exact price level you want.

That is one of the main reasons I had not been using BIN prices for many years. I am currently running a test with 200 domains prices with BIN prices at DAN.com.

Finally, I think that the VAT calculation at checkout is also better for European buyers as they know exactly what the invoice they will be receiving will be.

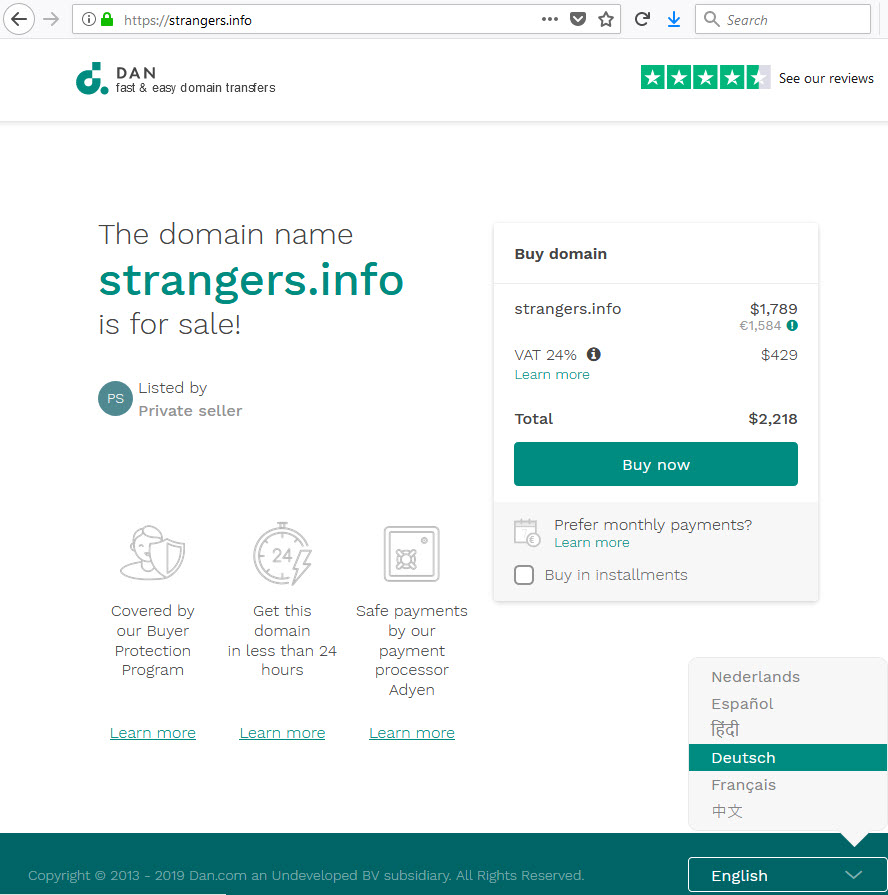

Here are a few screenshots on how DAN.com treats VAT at checkout:

I tested all different VAT scenarios for one of my domains using BIN and the DAN checkout works perfectly.

I tested all different VAT scenarios for one of my domains using BIN and the DAN checkout works perfectly.

Other international features

DAN.com has some other international features built in their landing pages and in its system.

First of all you have the option to choose what currency to use for pricing for your domain name portfolio. You can choose between USD, Euro and GBP.

Then you have some VAT options for your domains:

- Price excludes VAT

- Price includes VAT

- Do not show VAT at all

The last option is useful for private sellers and sellers outside of Europe. I have chosen the first option.

DAN.com also provides a translation of the domain landing page in 7 languages (English, German, Spanish, Chinese, etc.).

They also provide an estimate of the domain name price to your buyers in other currencies based on recent currency conversion rates.

Another nice feature is that you can see the buyer’s IP number and country while you are in negotiations.

Finally payments are processed by Adyen that is fairly well known in Europe as they were founded in the Netherlands. Of course now they are in a number of other locations like San Francisco, New York, Boston, São Paulo, London, Manchester, Singapore, Berlin, Paris, Stockholm, Madrid, Shanghai, Sydney and Mexico City.

(While DAN.com is a sponsor of this blog, this post was not endorsed or sponsored by DAN.com.)

(While DAN.com is a sponsor of this blog, this post was not endorsed or sponsored by DAN.com.)

OnlineDomain.com Domain Name News & Opinions

OnlineDomain.com Domain Name News & Opinions

OnlineDomain.com - © Copyright 2012-2025 - All Rights Reserved

OnlineDomain.com - © Copyright 2012-2025 - All Rights Reserved

So sellers who don’t live in Europe just choose the “Do not show VAT at all” option and be done with it, if I understand correctly.

Yes, that is what they do. And choose your currency.

Europeans have this VAT nightmare.