Domain Holdings had a strong Q4 2015.

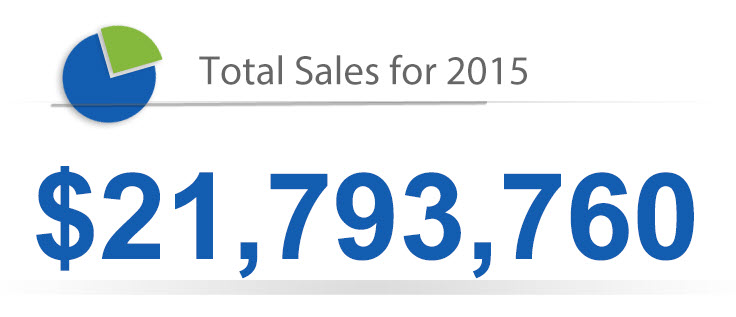

Q4 Highlights and Sales Summary Include:

- Total Sales: $6,358,902

- Average Weekly Sales: $489,146

- Average Sales Price (ASP): $105,982

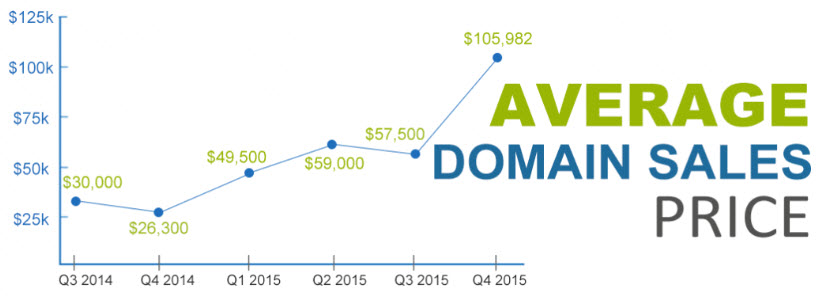

Sales Summary Q3 vs Q4:

Domain Holdings experienced growth across the board for Q4 2015. Their brokerage team generated $1.82M more (40% increase) in sales in Q4 than in Q3. The overall average sales price is up from $57,424 to $105,982, and the average sales per week increased by 40% from Q3 to Q4, surpassing $485,000.

The overall average sales price (ASP) for domains in Q4 was $105,982, an increase of 84% from Q3. Although ASP fluctuates from quarter to quarter, Domain Holdings has seen continued growth in the overall ASP throughout the fiscal year, making Q4 among our highest numbers in the last eight quarters.

In Q4, The United States and China continue to be the two largest markets for Domain Holdings, accounting for 86% of total sales. Sales to the Chinese market increased from Q3, due their interest in domain names of up to 4L or 3N.

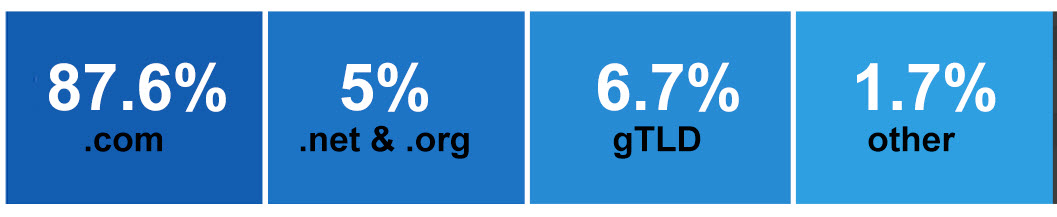

Buyers by Extension

The .com domain continues to remain the market leader, accounting for 86% of the sales in Q4. However, interest in gTLDs continue to grow and constitute a larger part of our business. Certain gTLDs, such as .io are especially in demand, as they are very popular in the tech and startup sectors.

The .com domain continues to remain the market leader, accounting for 86% of the sales in Q4. However, interest in gTLDs continue to grow and constitute a larger part of our business. Certain gTLDs, such as .io are especially in demand, as they are very popular in the tech and startup sectors.

Looking ahead…

Overall, Q4 was a success and an amazing end to a big year. Flippa’s acquisition of Domain Holdings has allowed Domain Holdings to build a solid foundation for future growth. They have increased their sales through the continued dedication to their existing clients (buy requests), secured more inventory, generated new relationships, matured pipelines, and launching new outbound marketing campaigns. In addition, Domain Holdings has expanded their team in size, function and experience in 2015. Their increased head count has allowed them to expand their service offerings, helping them to fulfill the needs of their existing clients, as well as the demands of a constantly growing client base.

Please check out an article written by Michelle Miller who sat down with Mark Daniel, the Senior Domain Broker, as we gain insight into the journey which led him to where he is today as one of the top brokers in the industry. In this article, Mark brings us into his domain – life before Domain Holdings, his approach, and his keys to success.

OnlineDomain.com Domain Name News & Opinions

OnlineDomain.com Domain Name News & Opinions

OnlineDomain.com - © Copyright 2012-2026 - All Rights Reserved

OnlineDomain.com - © Copyright 2012-2026 - All Rights Reserved

Granted, the comment I’m about to make is pedantic; but …

.IO is discussed as a gTLD when it isn’t. It’s a ccTLD.

And .COM / .NET / .ORG are grouped separately from gTLDs even though they all ARE gTLDs.

I wouldn’t be a stickler for just anybody; but DomainHoldings is a large player in the domain industry. Terminology helps keep us speaking the same language. It’s important to have these categories / distinctions mean 1 thing everywhere so that nobody reading a sentence in 1 place misunderstands a sentence written somewhere else.

You are right.

At first I thought that gTLDs were New gTLDs but then I read about .io and I was completely confused.

P.S. This really is relevant. My first assumptifn was that .IO sales were part of the 1.7% “other” category. But if DomainHoldings has classified that ccTLD as a gTLD, then .IO sales would be part of the 6.7% “gTLD” category. No idea where .TV and .ME are. This muddies the water considerably.

This is a private company right (meaning no SEC reporting)? And I don’t see them list the domains they sold. So what is there to back up these numbers?