The latest Escrow.com Domain Investment Index for Q3 2020 is out. The report provides insight into the domain name market for the third quarter of 2020, compared to previous quarters.

The latest data from Escrow.com indicates a recovery across most segments in Q3 2020 compared to Q2 2020 which was affected by the COVID-19 pandemic. This is a promising sign for the domain name market as the late recovery in Q2 2020 has continued into the last quarter. The spike of this recovery has achieved a stronger performance than Q3 of last year.

Escrow.com Domain Investment Index Q3 2020 highlights:

-

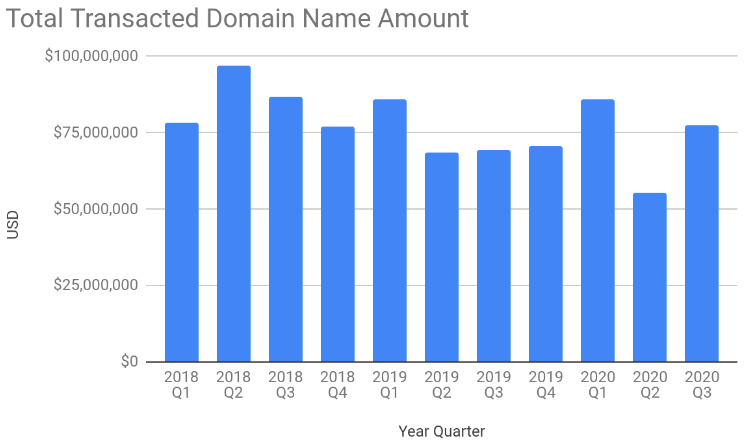

The total transacted domain name amount has recovered in Q3, after the lull in the previous quarter due to effects from the COVID-19 pandemic. The total domain name transaction amount for Q3 was $77.5 million, compared to $55.2 million in Q2.

-

We see a recovery across most leading countries in Q3. Total transactions in the US increased from $42.6 million to $58 million.

-

We see a jump in median price return rate to 20% in Q3 2020 compared to Q2 2020. This is expected given the weaker performance in Q2 2020.

-

Despite the meager performance in Q2 2020, Q3 2020 outperformed Q3 of last year. Median price return rate in Q3 2020 increased by 7% compared to Q3 2019.

-

Median price of domain names with content increased from $3,500 to $5,000, and median price of domain names without content increased slightly from $2,500 to $2,750.

-

Similarly, the total transacted volume of domain names with content increased to $12.3 million, while domain names without content increased to $41.75 million.

You can view the full report of Escrow.com’s Domain Index for Q3-2020 here.

OnlineDomain.com Domain Name News & Opinions

OnlineDomain.com Domain Name News & Opinions

OnlineDomain.com - © Copyright 2012-2026 - All Rights Reserved

OnlineDomain.com - © Copyright 2012-2026 - All Rights Reserved