Tucows Inc. (NASDAQ:TCX, TSX:TC), a provider of network access, domain names and other Internet services, today reported its financial results for the first quarter ended March 31, 2020. All figures are in U.S. dollars.

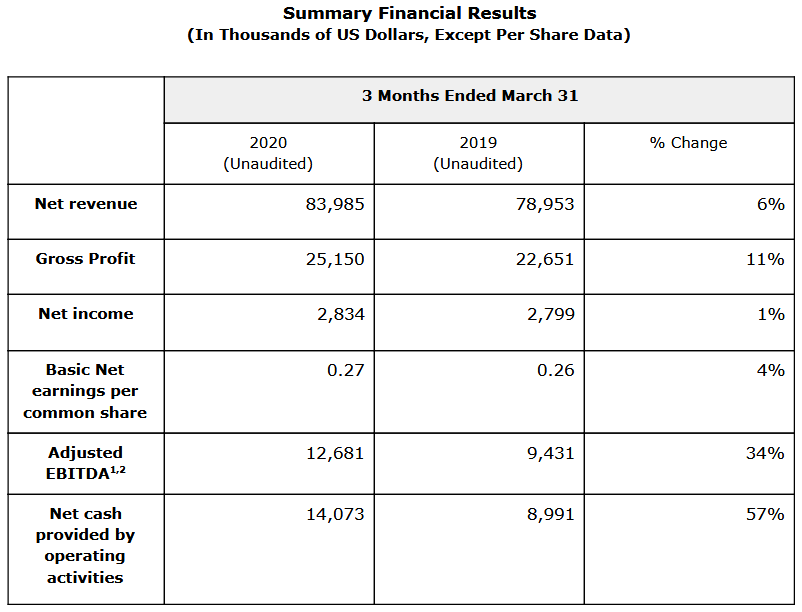

“The first quarter was a very solid start to 2020, highlighted by year-over-year growth in revenue and gross profit of 6% and 11%, respectively, and cash flow from operations of more than $14million,” said Elliot Noss,President and Chief Executive Officer, Tucows Inc.

“Our Domains business continued to benefit from our focus on high-quality reseller customers, which contributed to more than a 20% year-over-year increase in gross margin in the Wholesale channel. In our Ting Mobile business, as expected we benefited from the improved economics of our carrier relationships. And at Ting Internet, we continued to steadily expand the network, adding another new town, further expanding potential serviceable addresses, increasing the number of homes passed, adding new customers, and nearly doubling gross profit year-over-year with the contribution of the acquisition of Cedar Holdings, which we closed on January 1.”

Financial Results

Net revenue for the first quarter of 2020 increased 6% to $84.0 million from $79.0 million for the first quarter of 2019.Net income for the first quarter of 2020 increased 1.3% to just over $2.8 million, or $0.27 per share, from just under $2.8 million, or $0.26 per share, for the first quarter of 2019.Adjusted EBITDA1 for the first quarter of 2020 increased 34% to $12.7 million from $9.4million for the first quarter of 2019. Adjusted EBITDA for the first quarter of 2020 reflects a full quarter of contribution from the Ascio and Cedar Holdings acquisitions in March 2019 and January 2020, respectively.Cash and cash equivalents at the end of the first quarter of 2020 was $12.4 million compared with $20.4 million at the end of the fourth quarter of 2019 and $11.0 million at the end of the first quarter of 2019.

(During the first quarter of 2020, portfolio revenue consisted of individual sales from its surname portfolio following the sale of the Company’s remaining domain name portfolio in the fourth quarter of 2019. Going forward, portfolio revenue will only consist of surname portfolio sales.)

OnlineDomain.com Domain Name News & Opinions

OnlineDomain.com Domain Name News & Opinions

OnlineDomain.com - © Copyright 2012-2026 - All Rights Reserved

OnlineDomain.com - © Copyright 2012-2026 - All Rights Reserved