Global domain name growth has slowed down during the first quarter of 2019. That is not a concern to me as growth is bound to slow down sometime, especially for New gTLDs. We have enough domains as it is.

CENTR published its CENTRstats Global TLD Report covering status and trends in top-level domains with a focus on European ccTLDs (country code top-level domains).

CENTR is the association of European country code top-level domain (ccTLD) registries, such as .de for Germany or .si for Slovenia. CENTR currently counts 54 full and 9 associate members – together, they are responsible for over 80% of all registered country code domain names worldwide.

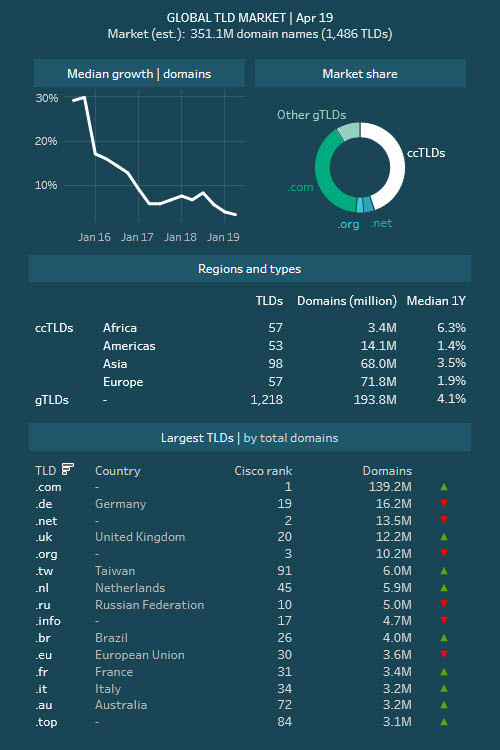

The global TLD market is estimated at around 351 million domains across 1486 recorded TLDs. Median domain growth among these TLDs has decreased to a record low of 3.4% year on year (top 500 median). Between ccTLDs and gTLDs growth rates are similar, with a range from 1.4% for ccTLDs in the Americas to a high of 6.3% for African ccTLDs.

In global market share trends, new gTLDs, which include well over 1000 TLDs, have a little under 10% of the market and show no immediate sign of increasing that. The rest is made up of around 267 ccTLDs with a combined share of 45%. This includes .com, which is the single largest TLD with 40% of all TLD registrations and other larger gTLDs such as .org and .net, both of which have seen declines of around 1% each over the past 3 years.

This quarter, Cisco umbrella ranking data has been introduced to the report. The rank shows the most queried TLDs based on passive DNS usage across the Cisco Umbrella global network of more than 100 billion requests per day with 65 million unique active users, in more than 165 countries. It provides an impression on usage and popularity of a TLD and may give additional insight when viewed in conjunction with registration metrics such as domain count.

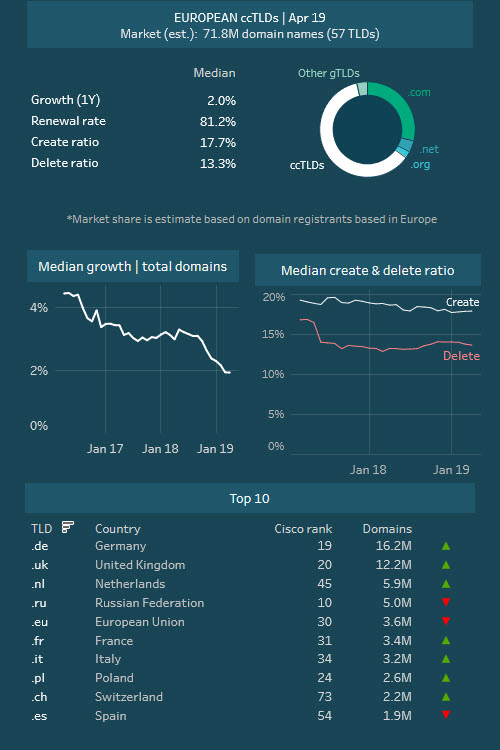

Across all recorded ccTLDs in Europe (57) there are roughly 71 million domain names under management. Growth in the sector has been slowing for years, most likely driven by a general slow down in new domain creations. In recent months, the long term growth trend fell sharply due to a bump in deletions. However this may now be stabilising due to a widening gap between creates and deletes. The median growth at April 2019 was recorded at 1.9% year on year with a high (relative to the other TLDs globally) median renewal rate of 84%.

Market share indicators provide a different view on uptake and loyalty to TLDs. Within Europe, the combined share of ccTLD domains is 61%. At country level, local ccTLDs have an average of 54% of the market share (based on domains registered by a registrant within the country). These figures have not changed significantly over the past few years, though other data sources such as Alexa domain ranks offer a different story. The Alexa rank of top 500 domains, which measures web pageviews per million in each country, shows an average of just 26% in favour of the local ccTLD, with signs of decrease. This figure should be treated with care given the small sample (500) of domains per country. CENTR will expand the sample and its analysis in coming editions of this report.

The ccTLDs who had the highest growth (by percentage) over the past 12 months were .pt (Portugal), .ie (Ireland) and .al (Albania).

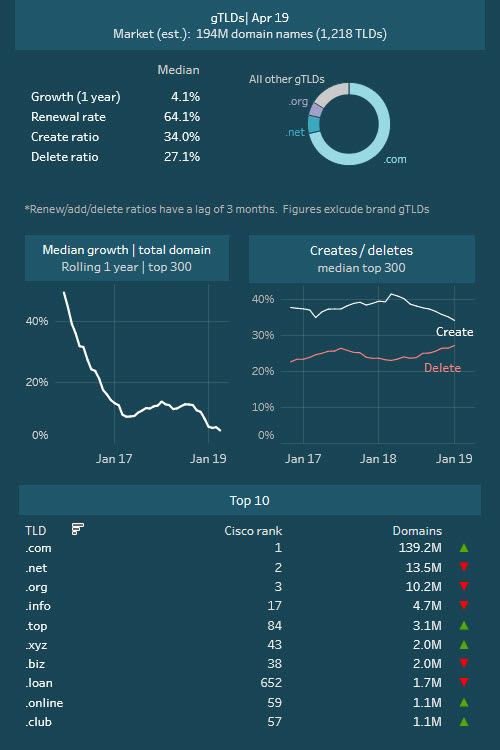

The combined domains under all recorded gTLDs globally total 194 million, 71% of which are under .com.

Median growth among gTLDs was 4.1% year on year (top 300) – its lowest recorded rate yet. Although the rate is still above the global average, gTLDs will face challenges in the coming months given other registration trends such as a declining create ratio, an increasing delete ratio and a relatively low renewal rate median of 64%. A silver lining to these figures is the median park ratio* (an estimate of the proportion of domains in a TLD which are used for parking or which have errors), which appears to be decreasing*. This may have a positive impact on domain usage and renewal rates.

Of the top 10 largest gTLDs by domain count, all are within the top 100 Cisco ranking list with the exception of .loan which ranks far below the group average, as well as having a relatively high park ratio*.

OnlineDomain.com Domain Name News & Opinions

OnlineDomain.com Domain Name News & Opinions

OnlineDomain.com - © Copyright 2012-2026 - All Rights Reserved

OnlineDomain.com - © Copyright 2012-2026 - All Rights Reserved

Good to know that the ccTLDs who had the highest growth recently were Portugal, Ireland, and Albania.

As I read from other sources, Portugal is now a popular place for startups, especially Lisbon, as the living cost is low relatively low though still you are living in the European Union.

Some UK companies have transferred part of their developer staff to Lisbon because rent is much cheaper than London.

gTLDs = .disillusionment

Cctlds will soon go into overall decline. It is being propped up by .tk which keeps most (all?) expired names.

Internet penetration is getting closer to 100%. Domains are now a mature market. New tlds are in decline depending on the exact timeframe you look at, and the numbers would be far worse if they weren’t “running the printing presses” with new extensions.

ccTLDs are doing fine and will continue to do fine for a lot of years.

.TK is irrelevant. I don’t even consider it, ever.

New gTLDs were in a bubble and still are. They come down to their normal levels in about 2-3 years.

K, you played in the GTLD space, you know your inquiries are down for the new G’s given what they were in the past few years, you can’t deny that fact. They maybe relevant with people who have no idea what they are doing, or with a sub $100 budget, so be it. We play in the 4 figure plus space, and don’t even deal with sub $500 offers, much like you do, so that is where the meat of the matter lies. Snoopy is on point, G’s will implode because the people who run the registries are more concerned with short term price spikes, and reserving expiring names for platinum programs, they will never gain traction like this. Sad but true, g’s are doomed, because you have execs who want .com success instantly, and profit for life, it’s just not that easy in this business.

Look at Donuts, and the ex ICANN head now running it, all the sudden price hikes coming.

Why would you bundle ccTLDs and gTLDs? Snoopy’s statement was about CCs, and they are doing ok. Anyway, .horse is the best extension and is going to rule them all.

Seems that the parking metric is based on that NTLDstats cargo-cult stuff. Totally unreliable and very misleading! The activity in some new gTLDs is OK but a few are dead zones. The danger is that many people are considering the new gTLDs as a single TLD. Some of the new gTLDs have renewal rates below 5%. However, 64% is not actually a low renewal rate for one year renewals.

@Snoopy .TK is a repurposed ccTLD rather than a real ccTLD. Real ccTLDs are dominating their local markets and .COM growth has plateaued in many of those country level markets. It is still used as the global TLD but the other legacy gTLDs are losing ground. There is a contraction underway with some of the non-COM legacy TLDs.

John said it best, gTLDS = .disappointment and .disillusionment

Some er…suckers… rushed out to grab them, but then after holding for a year or two with zero offers, zero traffic and a huge confusion factor, most quickly realized thy were .duds and let them drop, rather than paying the .wasteofmoney renewal fees.

Seem obvious we will now see a mass drop of the .sh_ts and a huge spike in demand for the .com gold standard.