- Tucows first quarter 2019 results include 13 days of contribution of Ascio Technologies (“Ascio”), which the Company acquired on March 18, 2019.

- Net revenue for the first quarter of 2018 included the recognition of $14.6 million in accelerated revenue related to the bulk transfer of nearly 2.65 million very low-margin domain names during that period.

- This Non-GAAP financial measure is described below and reconciled to GAAP net income in the accompanying table.

- Adjusted EBITDA for the first quarter of 2019 reflects the impact of the purchase price accounting adjustment related to the fair value write down of deferred revenue from the Ascio acquisition on March 18, 2019, which lowered Adjusted EBITDA by $0.2 million.

“Our Domain Services and Ting Mobile businesses continue to generate strong cash flows to support our investment in our outsized Ting Internet opportunity,” said Elliot Noss, President and Chief Executive Officer, Tucows Inc. “During the first quarter, we saw continuing steady progress on Ting Internet, as we further expanded our networks, increased the number of serviceable addresses, and grew our subscriber base. We also added our seventh town, Wake Forest, North Carolina, followed shortly thereafter by our eighth, Fullerton, California, just after quarter end. Our solid start to the year positions Tucows for improved growth in 2019 and beyond.”

Financial Results

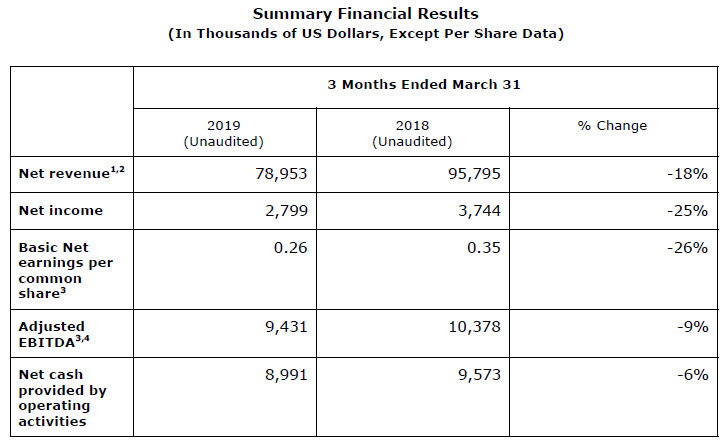

Net revenue for the first quarter of 2019 was $79.0 million compared with $95.8 million for the first quarter of 2018, with the first quarter of 2018 benefiting from accelerated revenue recognition of $14.6 million related to a bulk transfer of 2.65 million domain names during that period. Excluding the impact of the accelerated revenue, net revenue for the first quarter of 2019 decreased 3% com pared to the first quarter of 2018.

Net income for the first quarter of 2019 was $2.8 million, or $0.26 per s hare, compared with $3.7 million, or $0.35 per share, for the first quarter of 2018.

Adjusted EBITDA 5 for the first quarter of 20 19 was $9.4 million compared with $10.4 million for the first quarter of 2018 . Adjusted EBITDA for the first quarter 2019 reflects the impact of the purchase price accounting adjustment related to the fair value write down of deferred revenue from the Ascio acquisition, which lowered Adjusted EBITDA by $0.2 million. The estimated impact of the purchase price accounting adjustment related to the fair value write down of deferred revenue on Adjusted EBITDA is approximately $3.0 million, the majority of which will be reflected in our 2019 financial results.

Cash and cash equivalents at the end of the first quarter of 2019 were $11.0 million compared with $12.6 million at the end of the fourth quarter of 2018 and $16.6 million at the end of the first quarter of 2018.

About Tucows

Tucows is a provider of network access, domain names and other Internet services. Ting (https://ting.com) delivers mobile phone service and fixed Internet access with outstanding customer support. OpenSRS ( http://opensrs.com ), Enom ( http://www.enom.com ) and Ascio ( http://ascio.com ) manage a combined 25 million domain names and millions of value-added services through a global reseller network of over 38,000 web hosts and ISPs. Hover ( http://hover.com ) makes it easy for individuals and small businesses to manage their domain names and email addresses. More information can be found on Tucows’ corporate website ( http://tucows.com ).

OnlineDomain.com Domain Name News & Opinions

OnlineDomain.com Domain Name News & Opinions

OnlineDomain.com - © Copyright 2012-2026 - All Rights Reserved

OnlineDomain.com - © Copyright 2012-2026 - All Rights Reserved

Guess this is why we can expect .COM registration price increase, which will induce lower number of registration and push for higher domain registration price increase? This may be a good time to renew long-term (multi-year) .COM domain registration for our most valuable domains, before the prices go up?